Do you want to learn how to apply Jio Finance Personal loan online using the mobile app? Applying for a personal loan has never been easier with the Jio Finance loan app take control of your financial needs today!

In this post “How to Apply Jio Finance Personal Loan Online from a Jio Finance Loan Mobile App? Today we are going to share the step-by-step guide to apply a Jio Finance Personal Loan Online Using the Mobile App.

If you need some extra money to meet unexpected expenditures or planning to make a big purchase Jio Finance Personal Loan is the easiest way to borrow money using the Jio Financial Services app loan service.

In this blog post, we’ll guide you through the simple steps to apply for a Jio Finance personal loan online using the mobile app.

How to Apply Jio Finance Personal Loan Online Using a Mobile App?

To apply for a Jio Finance personal loan online using the mobile app you need to follow these steps.

Table of Contents

Steps to follow to apply Jio Finance personal loan online.

- Downloading the MyJio App from the Google Play Store.

- Now register in the MyJio app using your jio mobile number.

- If you are already a registered member of the MyJio app, log in to your account.

- The fourth step is to complete your profile by entering the details asked by the company.

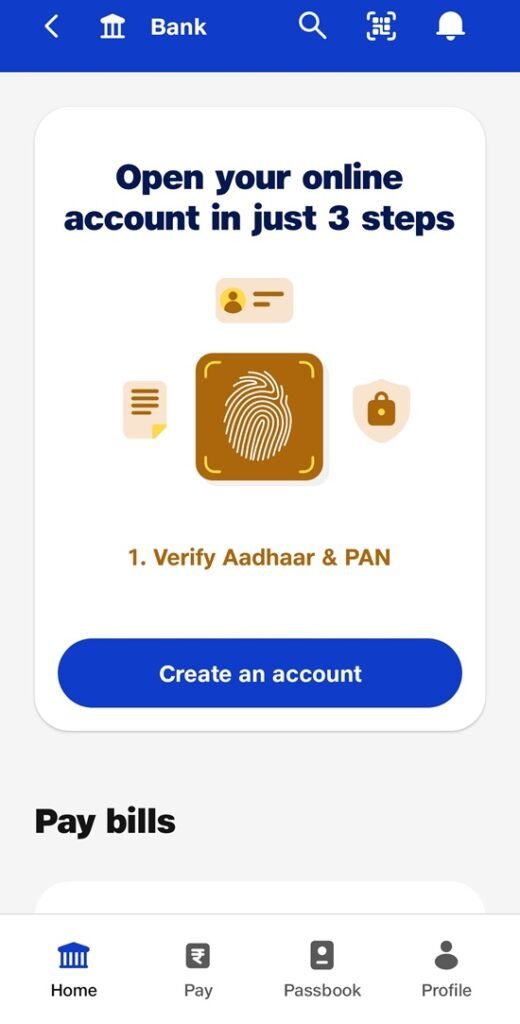

- Now navigate to the Bank section by clicking on the bank icon. The below interface will be visible.

6. To create the bank account click on the “create an account” tab, now you will get the OTP in the mobile number that you have used to log in to the MyJio application, After entering the OTP you have to click “Verify and Proceed” button.

- Now provide Aadhar and Pancard details.

- Click on Loans

- The third step is to check your eligibility for a Jio Finance Personal Loan by entering your name, date of birth, and PAN.

- Now fill bank account details.

- You need to complete a video KYC with your original PAN card and Aadhaar.

- Once verified, the money will be credited to your bank account as per the requirement filled by you.

Benefits of Jio Finance Personal Loan

- No physical documents are required to apply for a Jio Financial Personal loan online.

- You need to provide a phone number, Aadhaar Number, and PAN number to apply for an online Jio Finance Personal Loan using a mobile.

- Instant online approval with minimal eligibility criteria.

- No collateral is needed for the loan.

- Flexible repayment tenure ranging from 12 to 36 months.

Applying for a Jio Finance personal loan online is a quick and easy process. If you want to know about Jio finance loan eligibility and interest rates in detail follow the link.

FAQ

What is the repayment period for the Jio finance personal loan?

The Jio Finance personal loan lets you choose a repayment period that works for you, ranging from 12 to 36 months.

Can the repayment period for Jio finance personal loan be extended?

Yes! one can extend as per the mutual agreement between the bank and the borrower.

Is Jio Finance Persoanl loan online?

Yes, Jio Finance Persoanl loan online instantly for salaried and self-employed individuals through their website and the MyJio App.